Last week, Citizens Property Insurance Corp., the state’s insurer of last resort, experienced a significant reduction in its number of policies, dropping nearly 100,000 policies and reaching the lowest total in almost three years. As of Friday, Citizens had 844,688 policies, down from 945,005 policies the previous week and 942,810 policies two weeks earlier.

The decline is attributed to the “depopulation” program, where eight private insurers were approved to assume Citizens policies. This program allows private insurers to take over specific numbers of Citizens policies with regulatory approval.

A report to be presented at the Citizens Market Accountability Advisory Committee meeting on Wednesday indicated that regulators approved a maximum of 342,918 Citizens policies to be assumed last week. However, the actual number of policies transferred is typically much lower than the approved maximum.

The last time Citizens’ policy count was below 850,000 was in spring 2022, with 817,926 policies on March 31, 2022, before rising to 851,006 on April 30, 2022. Citizens had as many as 1.4 million policies in 2023, due to private insurers dropping customers and increasing rates amid financial difficulties. The number of property policies has decreased because of multiple depopulation rounds and improved conditions in the private market, according to insurance officials.

Citizens President and CEO Tim Cerio informed a House panel this month that Citizens anticipates ending 2025 with slightly fewer than 771,000 policies. Additional depopulation rounds are scheduled for March and April.

State leaders have consistently aimed to reduce the number of homeowner policies in Citizens, partly due to the financial risks posed by major hurricanes. If Citizens lacks sufficient funds to pay claims, policyholders statewide, including non-Citizens policyholders, could face extra charges known as assessments.

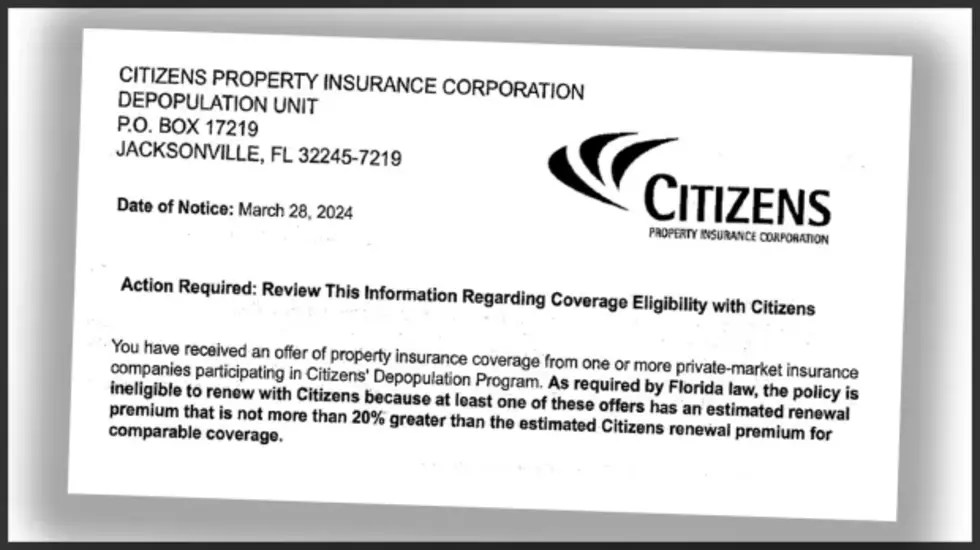

However, the depopulation program can also lead to higher costs for customers who are transferred to private insurers. A law requires Citizens customers to accept coverage offers from private insurers if the offers are within 20 percent of the cost of Citizens premiums. For example, a homeowner would have to accept an offer from a private insurer that is 19 percent higher than the Citizens premium.

In October 2019, Citizens had as few as 419,475 policies. Cerio mentioned to the House Insurance & Banking Subcommittee this month that such low totals might have been artificially reduced.

Follow the St. Pete-Clearwater Sun on Facebook, Instagram, Threads, Google, & X

(Image credit: South Florida Sun Sentinel)

PIE-Sun.com: local St. Pete-Clearwater news

Leave a comment