New state data reveals that sky-high deductibles are a major reason for insurance claim denials.

After enduring years of high insurance premiums, the recent hurricane season has tested insurance companies. However, many Tampa Bay area homeowners feel let down by their insurance providers.

Local news WFTS is delving deeper into why numerous hurricane claims are being “Closed without Payment” or outright denied.

Previous reports from WFTS highlighted that more than half of the denials during Hurricanes Debby and Helene were due to those storms being classified as flood events, which standard property insurance does not cover.

However, further analysis shows that nearly half of the claims denied during Hurricane Milton were due to claims not meeting the high deductibles.

Chad Zalva, a single father in Riverview, chose a lower insurance premium for his modest two-bedroom home post-divorce. Unknowingly, this choice resulted in a $7,200 deductible, which was too high when he needed to file a claim after Hurricane Milton.

“The deductible is just outrageous,” Zalva commented, explaining minor damages like fallen soffits and a damaged screen door, estimated at $2,500 by his insurer, and $4,500 by a contractor, didn’t qualify for coverage.

He has Tower Hill Insurance, which has not responded to WFTS’s inquiries for comment.

Contrastingly, Liz Ann from Tampa, a single mother, opted for higher coverage with Citizens Property Insurance, deliberately increasing her premiums to ensure protection. She maintained a lower deductible and took preventive measures like tree removal. Despite these efforts, her claim after Hurricane Milton was denied because the damage was below her $3,774 deductible.

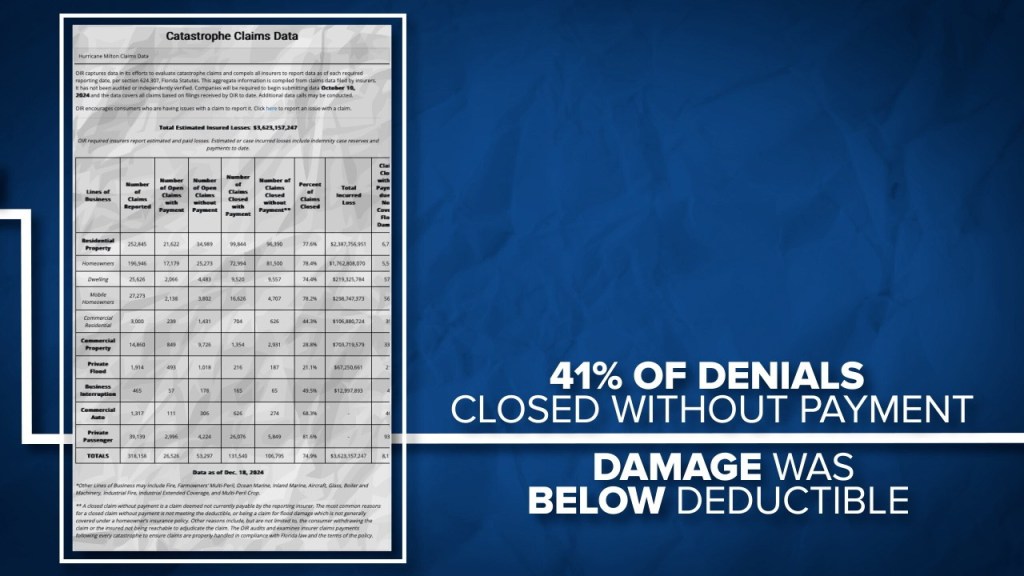

The Office of Insurance Regulation’s data indicates that 77% of claims from Hurricane Milton have been closed, with 49% closed without payment, largely due to damages falling below the deductible threshold.

Citizens Property Insurance CEO Tim Cerio clarified to lawmakers that there’s no financial incentive to deny claims, yet 49% of their claims from three hurricanes (Debby, Helene, Milton) were closed without payment, with 35% of these due to high deductibles.

Michael Peltier from Citizens explained that hurricane deductibles are set by Florida legislation, often ranging from 2% to 10% of the home’s insured value, meaning substantial out-of-pocket costs before insurance kicks in.

State Insurance Commissioner Mike Yaworsky noted that these high deductibles are mandated by law, designed to balance the cost of catastrophic losses. He suggested that lowering deductibles would likely increase premiums, presenting a trade-off for policyholders.

This news investigation underscores a complex issue where homeowners are caught between high premiums and even higher deductibles in the aftermath of hurricanes.

Follow the St. Pete-Clearwater Sun on Facebook, Instagram, Threads, Google, & X

(Image credit: WFTS)

Leave a comment