While many Florida homeowners, like Barbara Leon of Apopka, continue to face rising insurance premiums, state officials are reporting signs of improvement in the property insurance market. Leon, who has lived in her home for nearly 40 years, reflects on the dramatic rise in costs.

“I remember when the rates were low,” Leon said. “I never thought they’d go this high.”

However, during a recent presentation to the Florida Senate Banking and Insurance Committee, industry leaders shared encouraging news about the state’s insurance landscape.

“We continue to see good news emerging as we go forward,” said Mike Yaworsky, Florida’s Insurance Commissioner.

Yaworsky noted that while the average annual cost of homeowners insurance in Florida remains high—around $3,700—the market has stabilized over the past year and a half, thanks in part to reforms aimed at addressing systemic issues.

Several factors, including hurricanes, fraudulent claims, and inflation, have contributed to the skyrocketing premiums. However, recent legislative changes appear to be yielding positive results, offering hope to homeowners.

One concern for Florida’s insurance market is the potential impact of the ongoing California wildfires on the reinsurance market—a global system that allows insurers to manage risk.

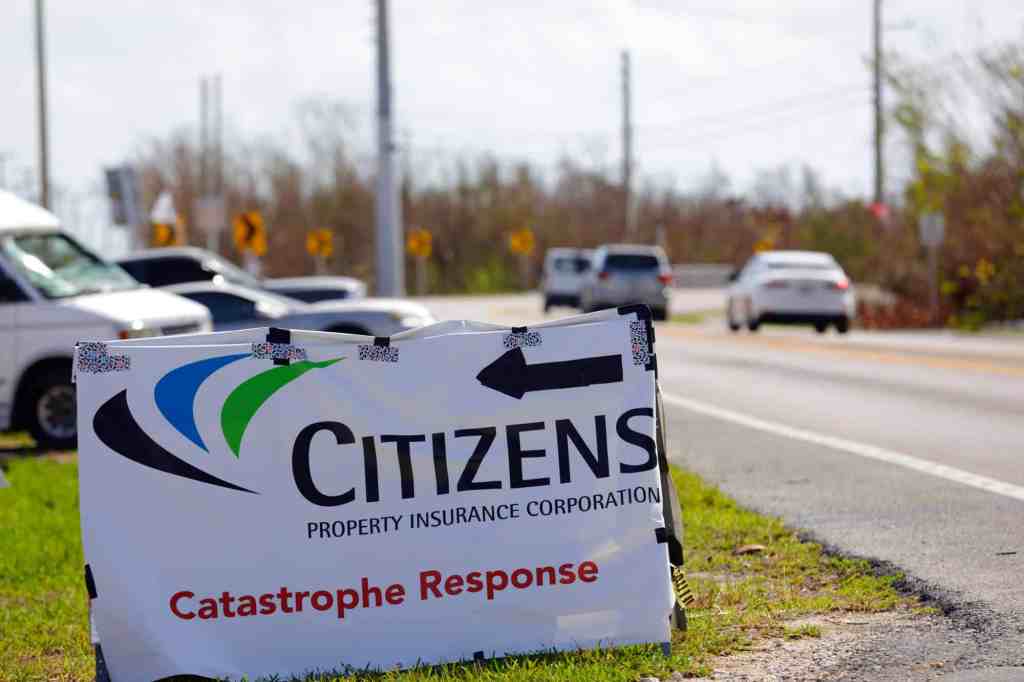

Tim Cerio, executive director of Citizens Property Insurance Corporation, addressed this uncertainty, saying, “We don’t know yet. We’ve asked our consultants to evaluate the situation, but it’s too soon to say.”

If the wildfires adversely affect the reinsurance market, Florida could see ripple effects in the form of higher premiums. The data presented to lawmakers, compiled as of January 4, predates the start of the wildfires, making their impact difficult to assess at this time.

Despite these uncertainties, state officials remain cautiously optimistic about the future of Florida’s property insurance industry, pointing to the success of recent reforms and efforts to stabilize rates.

Follow the St. Pete-Clearwater Sun on Facebook, Instagram, Threads, Google, & X

(Image credit: Click Orlando)

Leave a comment